5 Questions You Need To Ask Before Choosing Your Global PEO

You’re ready to expand globally, and now you want the help of a Professional Employer Organisation. Deciding that you need help is a good start. However, this is not the hard part.

The hard part is choosing the right Professional Employer Organisation, or PEO for short. It is important to choose a trustworthy partner. After all, they will essentially become part of your company.

It is of the utmost important to choose the right PEO. This is especially true if you want to enter new markets around the world. If you do things right, then you’ll not only remain in business, but you’ll grow your business quickly, and will reduce employee turnover.

There are many PEOs out there. How do you choose the right one? Here’s a few tips to help you select the right UK PEO.

1. Does The PEO’s Clients Stand By Them

Many companies will say whatever necessary in order to get your business. They do this when they want you to purchase their produces and/or services. Sure, there’s nothing wrong with touting yourself, but the truth is you want honest and unbiased feedback from a PEO. Ask prospective PEOs if they can provide you …

Continue reading

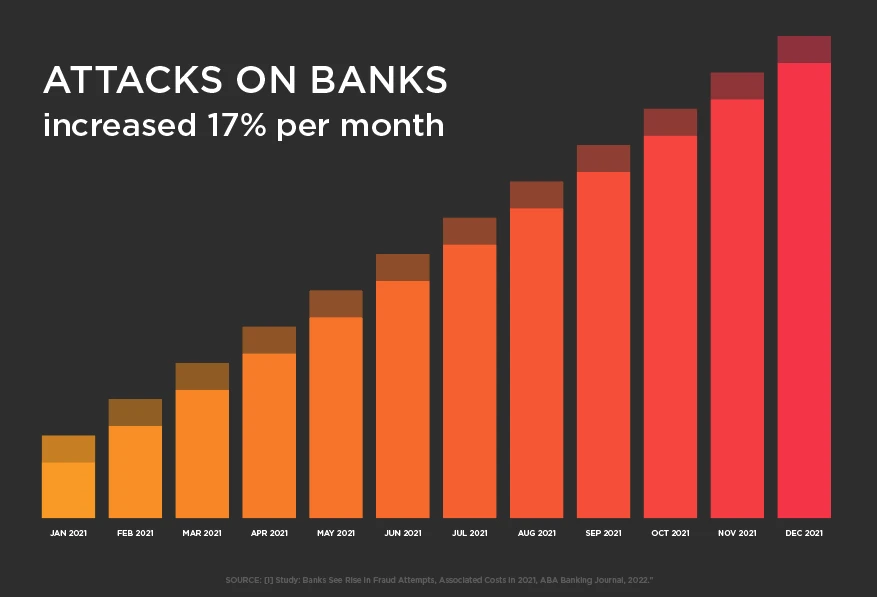

There’s never been a more complex time for financial services firms to try and manage risk. From an expanding range of cyberthreats, such as ransomware and third-party vulnerabilities, to business and operational risks such as regulatory compliance and data security, companies need to be more aggressive than ever in reducing risk, in all its forms.

There’s never been a more complex time for financial services firms to try and manage risk. From an expanding range of cyberthreats, such as ransomware and third-party vulnerabilities, to business and operational risks such as regulatory compliance and data security, companies need to be more aggressive than ever in reducing risk, in all its forms.