The Perfect Self-Employed Ecosystem To Attract The Success You Want

Are you tired of the nine-to-five grind and yearning to be your own boss? Starting a self-employed venture can be an exciting prospect, but it requires careful planning and the creation of the perfect ecosystem to ensure your success. In this article, we’ll explore the essential elements of a thriving self-employed ecosystem that will attract the success you desire.

1. Define Your Passion and Expertise

The first step in creating a successful self-employed ecosystem is to identify your passion and expertise. What do you love doing? What skills do you possess that can add value to others? By aligning your business with your passion and expertise, you’ll not only enjoy the work you do but also have a competitive edge in the market.

2. Set Clear Goals and Objectives

Goal setting is vital in any entrepreneurial journey. Define clear, specific, and achievable goals for your self-employed venture. Whether it’s financial targets, the number of clients you want to serve, or personal milestones, having a roadmap will keep you focused and motivated.

3. Build Your Personal Brand

In the digital age, personal branding plays a crucial role in attracting success. Establish yourself as an authority in your field by creating a …

Continue reading

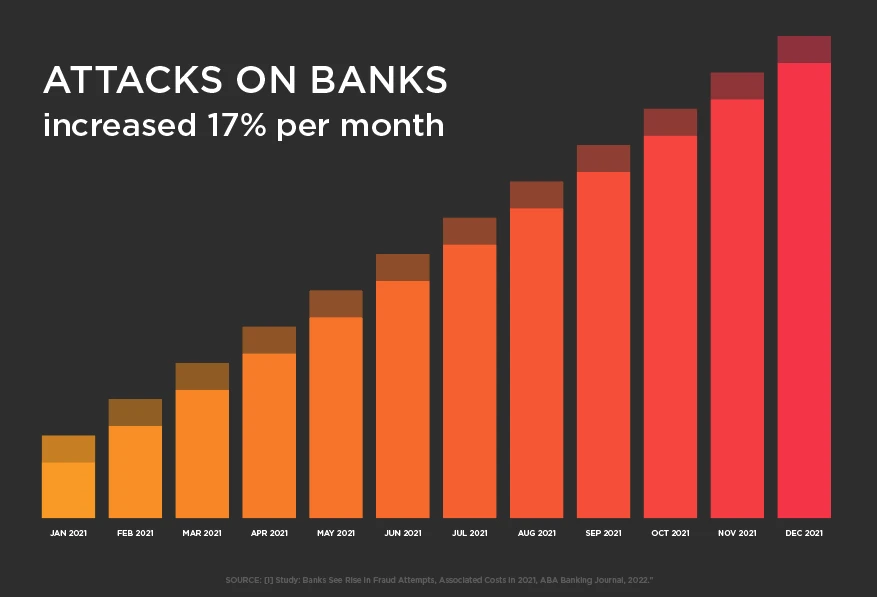

There’s never been a more complex time for financial services firms to try and manage risk. From an expanding range of cyberthreats, such as ransomware and third-party vulnerabilities, to business and operational risks such as regulatory compliance and data security, companies need to be more aggressive than ever in reducing risk, in all its forms.

There’s never been a more complex time for financial services firms to try and manage risk. From an expanding range of cyberthreats, such as ransomware and third-party vulnerabilities, to business and operational risks such as regulatory compliance and data security, companies need to be more aggressive than ever in reducing risk, in all its forms.